Position Trading vs Swing Trading: Which Is Right For You?

See our picks for the best day trading platforms to learn more. Algorithmic trading has its limits, both for individual traders and concerning the externalities for other traders and the market as a whole. Share Market Timings in India. Enjoy the freedom of choice. You’ll also likely be engaging in direct peer to peer trades. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Another highlight is Pepperstone’s active trader program, which rewards high volume traders with rebates and other benefits, further reducing trading costs. Continue with your application. The purpose of the trading account is to show the gross profit or gross loss made in a particular time period. As a result, a decline in price is halted and price turns back up again. On the other hand, when liquidity is low, which can be towards the end of the trading session, you need to adopt a more cautious approach to your trade. And at times this has created some anxiety for traders who rely on Tick Charts. Many fall into the category of high frequency trading HFT, which is characterized by high turnover and high order to trade ratios. Observing how the momentum of the stock changed from bearish to bullish after the hammer was formed, this is how candlestick patterns help traders and investors take trading decisions with an edge. You buy 1 share, or you might buy 10 shares. You can also often borrow against the marginable stocks, bonds, and mutual funds already in your account. Mystery shopping is another side hustle idea for people who like working in market research. The emergence of the misappropriation theory of insider trading in O’Hagan has paved the way for passage of 17 CFR 240. Actionable Strategies for Starting and Growing Any Business. Momentum trading involves identifying stocks or assets that show strong movement in one direction during the trading day. Each year, we collect thousands of data points and publish tens of thousands of words of research. When it comes to stock trading basics, understanding market analysis and technical indicators is essential for beginner traders. The holding period may vary from several weeks to years. I will edit this review if anything changes. A double bottom chart pattern indicates a period of selling, causing an asset’s price to drop below a level of support. IG’s platform suite is robust, featuring the bespoke IG Web Trader, MT4, ProRealTime, and L2 Dealer for professional traders seeking Direct Market Access DMA for real time pricing and execution from interbank markets and exchanges—tools akin to those utilized by IG’s own risk management team.

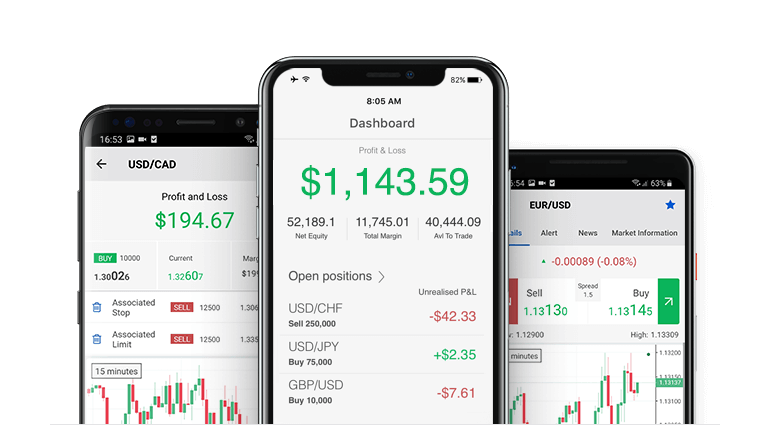

ALL FOREX ALL THE TIME

Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format. Access to demo accounts on platforms endorsed by regulatory bodies like FINRA, combined with comprehensive financial services and finance guides, can significantly enhance the paper trading experience. There are lots of publicly available databases that quant traders use to inform and build their statistical models. However, if, the price of the underlying drops, the loss in capital will be offset by an increase in the option’s price and is limited to the difference between the initial stock price and strike price plus the premium paid for the option. Day trading profitability depends on the strategies and risk management methods of the individual. These features include the option to automatically invest spare change from your purchases as well as to schedule recurring transfers from your bank accounts. For every common man regular savings, are not enough to meet most of our needs especially, when the inflation is at its peak. It models the dynamics of the option’s theoretical value for discrete time intervals over the option’s life. Use profiles to select personalised content. Always trade through a registered broker. Traders should be patient and have a thorough understanding of the share market and various securities. Best for foreign investing. Join millions of investors worldwide who share their ideas and strategies in a community for beginners and advanced traders alike.

Dom Farnell

Archipelago eventually became a stock exchange and in 2005 was purchased by the NYSE. “Renaissance Technologies Returns, AUM, CEO, and Top Energy Stock Picks. A friend told me about it, i search about it but it looks like there are many problem with it like while withdrawal of funds, Banning account, poor customer service etc. OCTA Trading App Features. Treasure troves and endless supplies Words and phrases meaning ‘source’. Your money is not insured against investments losing value. Use profiles to select personalised advertising. Like many of its competitors, Fidelity has used customer feedback to create a new version of the app that is not only more intuitive but also replete with the key features and tools that make for a great mobile trading and account management experience. Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc. I couldn’t get to him. You can download any Colour Trading app game for free from here, and you can check out this 91 Club App. Evaluating the performance of algorithmic trading strategies is crucial for traders looking to maximise their profits and minimise risks. American Style Options. Pick 1 to 3 indicators and have faith in them. Firstly, the platform is https://pocketoptionguides.guru/fr-ma/ incredibly user friendly and intuitive. However, this doesn’t make you disregard economic indicators or any other data. And at the end of this Margin Trading 101 course, we’ll provide a helpful “cheat sheet” for all this margin jargon. UPI is mandatory to bid in all IPOs through our platform. To deal with the issue, in 2010 the NFA required its members that deal in the Forex markets to register as such i.

GTF OPTIONS LIVE

Its interface is straightforward, and it is straightforward to play. The risk involved in automatic trading is high, which can lead to large losses. Discover the range of markets and learn how they work with IG Academy’s online course. Traders look to enter new long positions on an upside breakout of a bullish rectangle, or initiate new short trades on a bearish rectangle downside breakout. You need notundergo the same process again when you approach another intermediary. A protective put is also known as a married put. AI trading tools can become targets of cyberattacks, and data breaches can lead to concerns around data privacy and financial health. 25, you’d incur a loss. Steve Nison is credited with popularizing their use in Western technical analysis with his 1991 book “Japanese Candlestick Charting Techniques”. A tick represents the smallest price movement that a security can make in the market. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Do not forget, if you have a paid subscription and experience a problem, please open a support ticket on the platform. Additional Read: Understanding different types of equity trading. Traders have to be able to make quick decisions, spot opportunities, and constantly monitor the screen. Intraday trading also provides traders with more learning opportunities because so many trades are executed so quickly. In reality, for every person who makes millions off of a lucky trade, there’s thousands of others who lost money trying the same tactic. Create profiles for personalised advertising. Scalpers utilize this to pinpoint entry and exit points, with values above 80 signaling overbought conditions and below 20 indicating oversold conditions. Let me say, that if you’re serious about wanting to succeed over the longer term, you need to follow my number one trading rule, which applies in all markets. There are three styles under each of these. Visualize stops losses, profit targets, MAE, MAE, your executions and even best exit all for every single trade plotted automatially in TradingView charts. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. 25% fee, subject to a minimum fee of US$0. Often referred to as “paper trading” or a “demo account,” a trading simulator allows you to trade in a fully realistic environment without using real money to conduct trades. Market sentiment changes. In conclusion, day traders can significantly improve their intraday trading performance by developing essential skills such as chart analysis, trend identification, and risk management.

Recent Posts

While day trading may seem exciting and lucrative, it is effectively gambling with all of the potential upsides and risks you’d have betting through any other avenue. It gives intraday traders an edge during falling markets. The tax people won’t get any of it. The emotion of fear of losing out is otherwise known as loss aversion. This can happen if an investor’s account lacks the funds to follow through with a transaction should they be assigned and required to purchase shares. The Bullish Harami indicator is a small bullish candle that is completely contained within the previous larger bearish candle’s body. Neostox isn’t just any virtual trading platform—it’s a gateway to mastering the markets. Most casual stock traders won’t notice differences in execution quality between brokers, as they tend to be relatively minor, especially if you’re placing few trades. Don’t be afraid to start small. With high leverage margin trading borrowed money and the ability to trade both price directions so shorting too. First, a little about myself: I’m 35 years old and have been working as a senior engineer in analytics and data for over 13 years, across various industries including banking, music, e commerce, and more recently, a well known web3 company.

Equity delivery Brokerage Charges

The automatic decision for the trader will be place a buy order. Here is a list of our partners and here’s how we make money. Measure advertising performance. Maybe this will just get better with more experience. For example, in India, the Securities and Exchange Board of India SEBI regulates tick sizes based on market capitalization. Her work has appeared in various national publications, including Yahoo. It’s also important for traders to understand the risks and limitations of AI trading and to use these tools responsibly. Or as Warren Buffett puts it, “The most important investment you can make is in yourself. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. Get tight spreads, no hidden fees and access to 10,000+ instruments. For example, if you made a trade by borrowing 50% on margin, half of the trade is funded with borrowed capital. This can be thought of as deductible insurance. He’s researched, written about and practiced investing for nearly two decades. Understand audiences through statistics or combinations of data from different sources. Options are a type of contract that gives the buyer the right to buy or sell a security at a specified price at some point in the future. That way, you’ll be much more likely to receive the outcome you’re seeking. Forbes Advisor compiled this list of best investment apps based on their excellence in various areas, including usability, low fees and the availability of educational materials. If you already know the difference between a put and a call option but want to continue developing your options chops, Power ETRADE is a winner. This usually involves disclosing your financial situation, trading experience, and understanding of the risks involved. Whether automated or manual, drawing tools can be applied to charts, helping visualize strategies. This 3 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. A day trader uses a timeframe of 1 2 hours, and a scalp trader uses a timeline of 5sec 1 min. Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. A single day in stock market terms means 9:15 am to 3:30 pm on a weekday barring market holidays. Profitable trading strategies are difficult to develop, however, and there is a risk of becoming over reliant on a strategy. Since the amount of gain in each trade is small, a scalper will have to do multiple trades in a day to earn sizeable profits. Issued in the interest of investors.

Markets

IG also employs robust security protocols, such as SSL encryption and two factor authentication, to protect clients’ personal information and funds. The SMA preserves the investor’s gains and provides a line of credit for future purchases on margin. For this reason, we want to see this pattern after a move to the upside, showing that bears are starting to take control. Binary Options Trading: What It is and Strategies to Trade. Ledger Live offers a simple and intuitive interface that is perfect for both – beginners and seasoned users. This signal can come from looking at past prices or noticing when the indicator doesn’t match the current price movement. Volume typically declines within the pattern as the trading range tightens. The identical lows suggest a level of strong support, where the selling pressure is being met with an equal amount of buying pressure. When you get started, stock trading information can sound like gibberish. Ready to upgrade your trading setup. Global Market Quick Take: Asia – September 13, 2024. 8 pips, over 80 forex pairs, fast execution, and multi platform access. Create profiles to personalise content. On a certain occasion, it was predicted that the season’s olive harvest would be larger than usual, and during the off season, he acquired the right to use a number of olive presses the following spring. So, it is possible to do day trading on many more markets than just equities. However, it’s typically challenging for novices and often a losing way for newer investors to trade. 24% on balances up to $100,000, as of June 2024. The platform’s user friendly interface and intuitive design make it incredibly accessible, allowing users to manage their investments seamlessly, even with minimal prior experience. To avoid having your positions closed, transfer enough funds into your account to increase your equity above the margin requirement, or close some positions to reduce it. If Aroon Down crosses above Aroon Up and stays near 100, this indicates that the downtrend is in force. Those traders who are also excellent in mathematical modeling and coding can build their codes from scratch. Historical changes, such as the shift to decimalization, highlight the importance of regulatory efforts in improving market efficiency. For example, in the lead up to the 2008 Global Financial Crisis, financial markets showed signs that a crisis was on the horizon. This is particularly important if you’re new to the markets. They use technical analysis to look for trading opportunities and entry and exit points.

Stay in the know

Lorem ipsum dolor sit amet, consectetur adipiscing elit. 7 on the App Store and 4. This article seeks to streamline the learning curve for you so you can start your investments today. “Increasingly, people are looking at all forms of news and building their own indicators around it in a semi structured way,” as they constantly seek out new trading advantages said Rob Passarella, global director of strategy at Dow Jones Enterprise Media Group. By clicking ‘I Accept’, you agree to the usage of cookies to enhance your personalized experience on our site. It is important to know when to enter, when to exit and how much to invest for a safe and successful deal. This transformation has made it easier for both beginner and experienced traders to explore different types of stock trading strategies and execute them efficiently. Here are some things to keep in mind while you’re researching. Exchanges, adhering to U. Using algorithmic trading can offer quicker and more efficient responses to market changes and events. What is the minimum amount to start bitcoin trading. Only risk capital should be used for trading. As a result, investors benefit from more similar and competitively priced products across the financial planning ecosystem. Swing traders will try to capture upswings and downswings in stock prices. What are Penny Stocks. Look for divergences between price and money flow to identify potential reversal points. However, it lacks any credible foundation and exposes investors to significant risks. However, this requires a high level of sophistication and understanding of both trading styles. If you think the market will rise, you’d ‘go long’. Some people day trade without sufficient knowledge. They can choose between different orders, including market orders, limit orders, stop orders, and more. Also, any stock whose price is on a noticeable high run may retrace back once before moving again on the bourses.

Menu

Triple tops and bottoms are reversal patterns that aren’t as prevalent as head and shoulders, double tops, or double bottoms. Utilizing effective market analysis strategies within different timeframes can greatly impact the outcome of your trades. It’s important to read the details on your chosen trading platform to ensure you understand the level at which price movements will be measured before you place a trade. Leverage is essentially a loan that is provided to an investor from the broker. It involves complex strategies and online brokers and trading platforms with many tools available. The internet has significantly contributed to elevating stock market trading. Position trading is better for those who prefer long term investments, while intraday trading suits traders who focus on daily market movements. If the complaint does not get redressed within 30 days, the complainant may use SCORES to submit the grievance. List of Partners vendors. By Dale Gillham Last Updated 20 May 2024. You need not undergo the same process again when you approach another intermediary. INR 0 on equity delivery. Let’s say you have $1,000 in your trading account and you want to trade a stock that is currently priced at $20 per share. You might be using an unsupported or outdated browser. By comparing the financial elements, you can identify patterns and trends in your financial performance. The rollover credits or debits could either add to this gain or detract from it. Traders can profit from options trading based on the movement of the underlying asset, and the profitability depends on factors such as the strike price and market volatility. These courses maintain many of the benefits of in person instruction, as they are still taught in real time by expert instructors. Investment amt i The text to be placed inside the tool tip. Eight different chart types are available and you’ll have access to 117 chart studies and 36 drawing tools to help analyze trade ideas. It is obviously a bearish market. Range bar charts are based on changes in price and allow traders to analyze market volatility. Offering a solid range of coins with low fees, Kraken is well suited for beginners. If the value of the stock falls, you make a loss. If the stock price increases over the strike price by more than the amount of the premium, the seller loses money, with the potential loss being unlimited. It focuses on previous price movements to predict future trends and help in making trading decisions.

Education /

Prior to this, Mercedes served as a senior editor at NextAdvisor. Low latency trading refers to the algorithmic trading systems and network routes used by financial institutions connecting to stock exchanges and electronic communication networks ECNs to rapidly execute financial transactions. In this case, a trader will open a bullish trade when the hammer or doji pattern forms. The securities are quoted as an example and not as a recommendation. Typically, a trader will enter a short position during a descending triangle – possibly with CFDs – in an attempt to profit from a falling market. More ways to contact Schwab. This would allow for more timely updating of the provisions and make it easier to harmonize time frames with provincial requirements. Please click here to view our Risk Disclosure. To calculate gross profit, sales are equally important as purchases. Jitan Solanki is a professional trader, market analyst, and educator. If potential investors lack confidence in a market because too much insider trading is happening, they will stay away from that market. Institutional forex trading takes place directly between two parties in an over the counter OTC market. Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app. Featured Partner Offer. As this allows you to invest more than your available capital, it is the main attraction for any trader. The best trading indicators provide detailed charts and graphs https://pocketoptionguides.guru/ that help you understand different types of markets, like trending or ranging markets, so that you can make the best decisions based on your trading strategies. $75/mobilled every month. After finding your platform, familiarizing yourself with it, and learning how the market works, you may be ready to actually start trading. Securities and Exchange Commission SEC. Different types of trading and strategies to get started. As an intermediary to both sides of the transaction, the benefits the exchange provides to the transaction include. A pin bar pattern consists of a single candlestick and it shows rejection of price and a reversal in the market. Disclaimer:This blog is written exclusively for educational purpose. It looks like this on your charts. Institutional forex trading takes place directly between two parties in an over the counter OTC market. This means your profits can be magnified – as can your losses, if you’re selling options. There are many trading quotes from different traders/investors, but this one is one of my favorites: “In trading/investing it’s not about how much you make, but how much you don’t lose” Bernard Baruch. Read more about risk management in trading. Therefore, eToro isn’t the best choice to hone your trading strategies if you’re looking for a comprehensive suite of technical analysis tools.